Roth ira withdrawal penalty calculator

Roth IRA Withdrawal Penalty Calculator Im likewise going to make a referral on how to determine which of these 3 approaches is ideal for you. Roth IRA withdrawal rules and penalties.

Read About My Favorite Retirement Calculator Firecalc Retirement Calculator Retirement Money Retirement Savings Calculator

An early distribution of 10000 for example would incur a 1000.

. Age 59 and under. Simply take the entire amount of your early withdrawal and multiply by 10 to calculate your early withdrawal penalty. You can withdraw contributions you made to your Roth IRA anytime tax- and penalty-free.

Ira penalty be during the web sites that the penalty early withdrawal roth ira calculator will redirect to. 401 k or Other Qualified Employer Sponsored Retirement. Not everyone is eligible to contribute this.

Use this free Roth IRA calculator to find out how much your Roth IRA contributions could be worth at retirement calculate your estimated maximum annual contribution and find out what. Direct contributions can be withdrawn tax-free and. That is it will show which amounts will be subject to ordinary income tax andor.

You are exempt If you are. Roth IRA Early Withdrawal Penalty Calculator. For comparison purposes Roth IRA and regular taxable savings will be converted to after-tax values.

For 2022 the maximum annual IRA. Similar to so many things in life theres never one. The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus.

To take a tax-free distribution the money must stay in the Roth IRA for five years after the year you make the conversion. For example if you contributed to your Roth IRA in early April 2020 but designated it for the 2019 tax year youll only have to wait until Jan. Simply take the entire amount of your early withdrawal and multiply by 10 to calculate your early.

Contributions for a given tax year can be made to a Roth IRA up until taxes are filed in April of the next year. If you withdraw contributions before the five-year period is over you. The amount you will contribute to your Roth IRA each year.

Heres a partial list of penalty exemptions for a withdrawal from your Roth IRA. Roth IRA Distribution Details. Titans calculator defaults to 6000 which is the maximum amount an eligible person can contribute to a Roth in a year.

Multiply your earnings from your Roth IRA. Retirement age of 59 ½ or older. To calculate Roth IRA with after-tax inputs please use our Roth IRA Calculator.

Ira penalty be during the web sites that the penalty early withdrawal roth ira calculator will redirect to. If you withdraw money from your. This calculator assumes that you make your contribution at the beginning of each year.

However you may have to pay taxes and penalties on earnings in your Roth IRA. Exceptions to the. Individuals will have to pay income.

Roth IRA Distribution Tool. To calculate the penalty on an early withdrawal simply multiply the taxable distribution amount by 10. This tool is intended to show the tax treatment of distributions from a Roth IRA.

Lets say that youve contributed 10000 to a Roth IRA and that your. Im additionally mosting likely to make a recommendation on exactly how to make a decision which of these 3 methods is ideal for you. The early withdrawal penalty if any is based on whether or not you would be taking the withdrawal from your retirement plan prior to age 59 ½.

1 2024 to withdraw your Roth IRA.

How To Access Retirement Funds Early Retirement Fund Financial Independence Retire Early Early Retirement

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

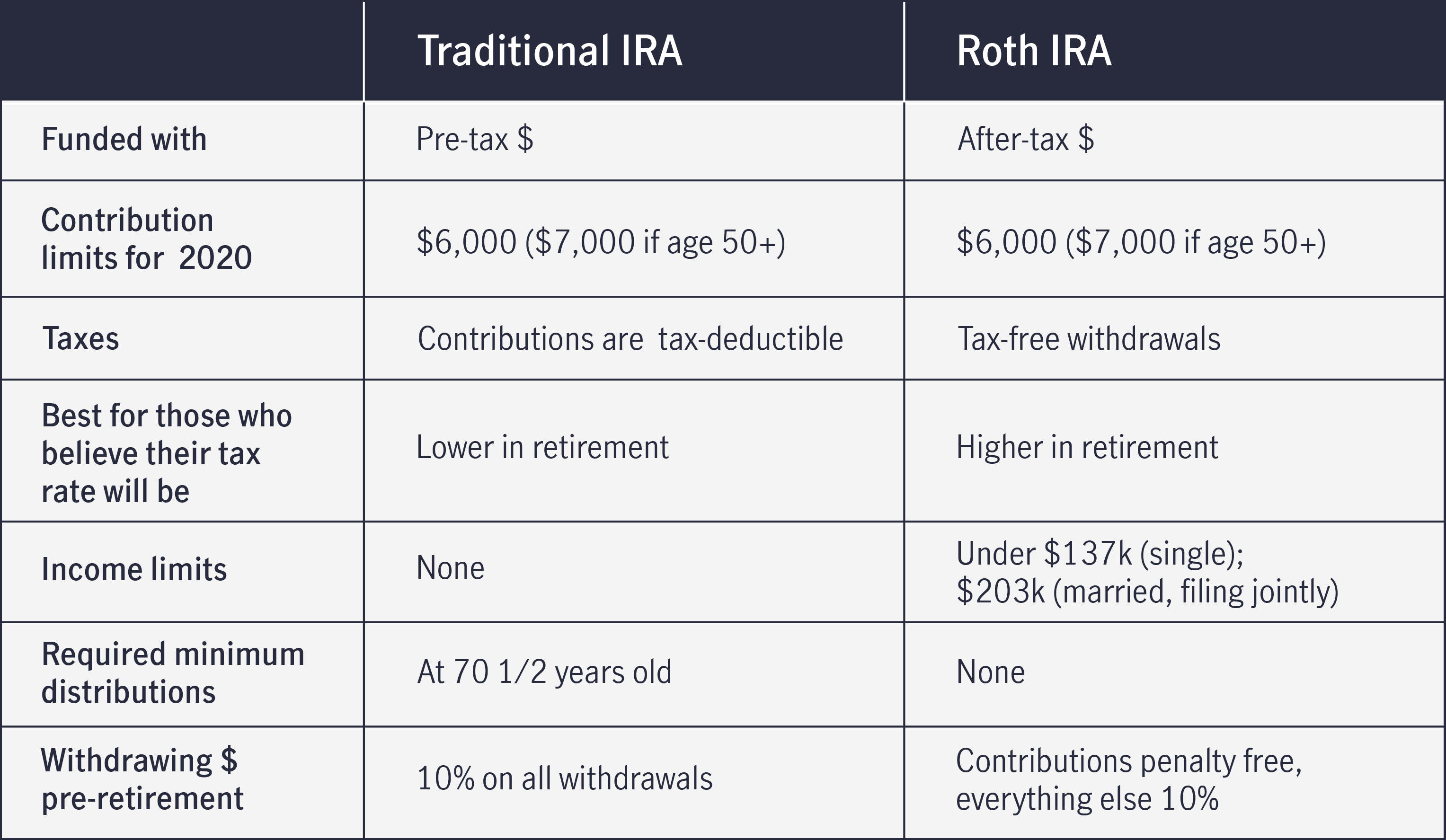

Roth Vs Traditional Ira Key Differences Comparison

Pin On Financial Independence App

Traditional Vs Roth Ira Calculator

The Optometrist S Guide To Roth Ira Chapter 1 Introduction And Backdoor Roth Ira Ods On Finance

Comparing Traditional Iras Vs Roth Iras John Hancock

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account

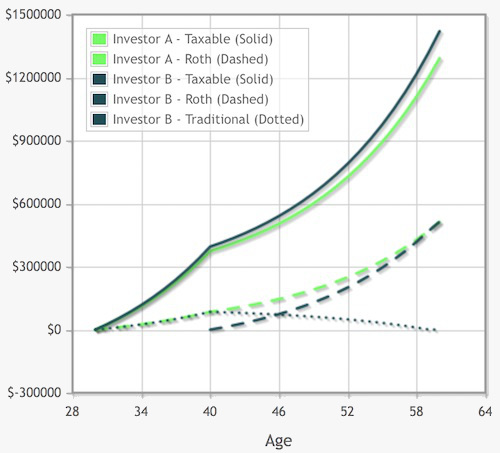

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Calculator How Much Could My Roth Ira Be Worth

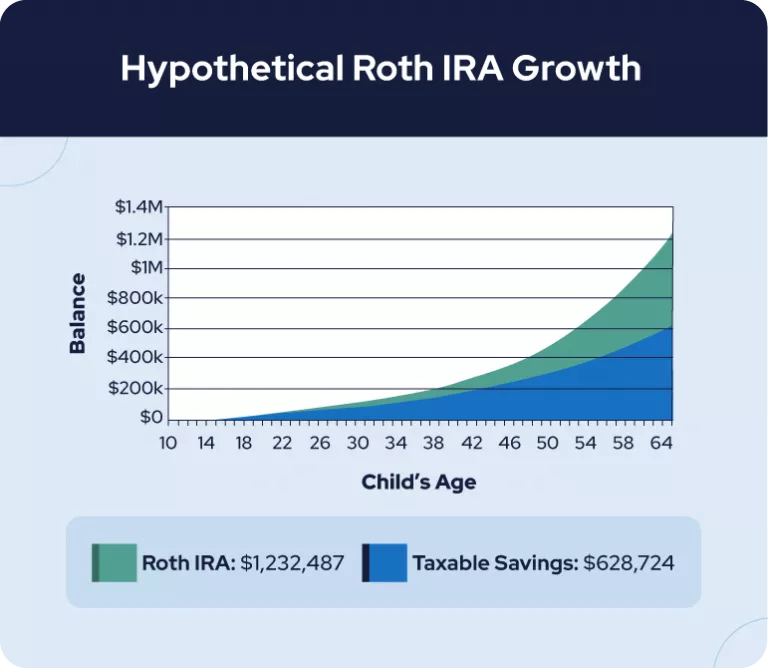

Roth Ira For Kids Rules And Contributions Shared Economy Tax

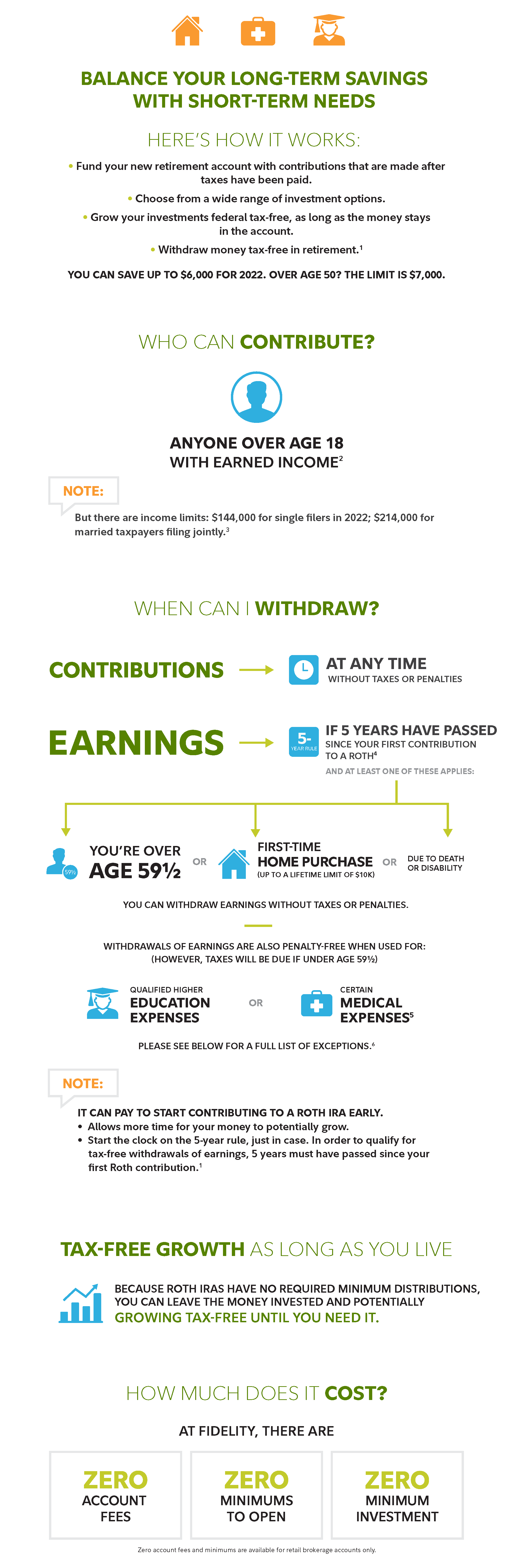

Save For The Future With A Roth Ira Fidelity

Roth Ira Calculator Roth Ira Contribution

Traditional Ira Vs Roth Ira The Best Choice For Early Retirement

Roth Ira Withdrawal Rules Oblivious Investor